Paycheck tax calculator 2023

Terms and conditions may vary and are subject to change without notice. After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return.

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora

1040 Tax Estimation Calculator for 2022 Taxes.

. You only have to answer the. 1 online tax filing solution for self-employed. This calculator is for 2022 Tax Returns due in 2023.

The Rhode Island tax rate is unchanged from last year however the. If you are creating a monthly budget list all sources of income for the month. You can use online tax software to help file your return.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. To fatten your paycheck and receive a smaller refund submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal income tax withholding. To receive a bigger refund adjust line 4c on Form W-4 called Extra withholding to increase the federal tax withholding for each paycheck.

TAX DAY IS APRIL 17th - There are 214 days left until taxes are due. Buffetts income came from investing. Start filing your tax return now.

Tax filing deadline. In 2022 President Bidens Build Back Better infrastructure bill intended to increase the electric car tax credit from 7500 to 12500 for qualifying vehicles but this bill failed. Was earning regular income.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Tax Return Access.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return.

On the next page you will be able to add more details like itemized. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Terms and conditions may vary and are subject to change without notice. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. TAX DAY IS APRIL 17th - There are 214 days left until taxes are due.

For 2021 the standard deduction increased to 12550 for single filers and 25100 for married couples filing jointly. On the next page you will be able to add more details like itemized. Estimate your self-employment tax and.

Start filing your tax return now. Standard deduction increase. Eligible colleges or other post-secondary institutions send Form 1098-T to students who paid qualified educational expenses in the preceding tax year.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. IT is Income Taxes. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Use this simplified payroll deductions calculator to help you determine your net paycheck.

If you get paid weekly you can base your budget on 4 weeks. Please note this calculator is for the 2022 tax year which is due in April 17 2023. Save money on taxes and see how Income Tax and National Insurance affect your income.

Terms and conditions may vary and are subject to change without notice. Enter your filing status income deductions and credits and we will estimate your total taxes. Scotland Tax Band Tax Rate Taxable Income.

Sales of electric vehicles continues to grow through 2022 and 2023 as more options are given to consumers. UK Income Tax excl. Estimate your tax refund and where you stand Get started.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions. Tax Return Access.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Terms and conditions may vary and are subject to change without notice. Its important you are aware of the tax and paycheck laws in Florida you are required to follow.

This 2019 Tax Calculator will help you to complete your 2019 Tax Return. You can use our free Michigan income tax calculator to get a good estimate of what your tax liability will be come April. Qualified expenses include tuition any fees that are required for enrollment and course materials required for a student to be enrolled at or attend an eligible educational institution.

There are also a number of state tax credits available to taxpayers in Oregon. 2023 to 80 2024 to 60 2025 to 40 and. Terms and conditions may vary and are subject to change without notice.

Americas 1 tax preparation provider. Rhode Island Income Tax Rate 2022 - 2023. Putting money at risk to help companies grow and thus making his money grow along with them.

If you actually get paid biweekly you may want to base your budget on just two weeks of pay then use your extra paycheck twice per year to do something special. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. She got a paycheck.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Tax Return Access. October 17 2022 is the deadline if you requested an extension.

Use our UK salary calculator to find out how much you really earn. As a result many taxpayers are unaware of the true amount they pay in payroll taxes. UK Tax Rates for 2022 2023.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. The standard deduction for the 2022 tax year due April 15 2023. Start filing your tax return now.

Bentle K Berlin J and Yoder C. Tax Return Access. This calculator is integrated with a W-4 Form Tax withholding feature.

Know how much to withhold from your paycheck to get a bigger refund Get started. Those with an Oregon 529 College Savings Plan had a carry forward option available until December 31 2019 and can still carry forward any unused subtraction before that date until 2023. April 18 2022 was the big tax deadline for all federal tax returns and payments.

Claim your 7500 credit if you purchased a new electric vehicle EV in 2022. You can use our free Wisconsin income tax calculator to get a good estimate of what your tax liability will be come April. So make sure to file your 2019 Tax Return as.

2020 September 18.

Income Tax Bands 2022 2023 United Kingdom

35k Salary After Tax In Philippines 2022 Philippines Salar

Income Tax Calcuation 2022 23 Or Ay 2023 24 How To Calculate Income Tax 2022 23 Youtube

40 000 A Year Is How Much An Hour Is It A Good Salary For 2023 Blue World Dreams

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

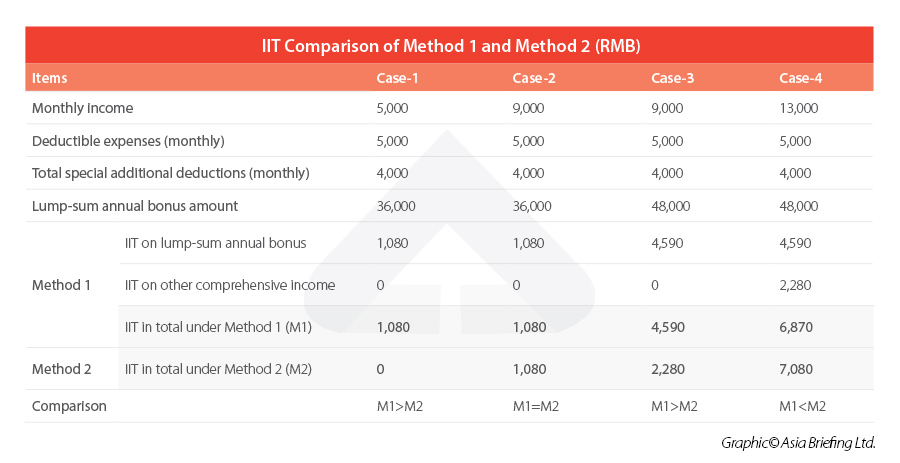

China Annual One Off Bonus What Is The Income Tax Policy Change

China Annual One Off Bonus What Is The Income Tax Policy Change

Salary Rates Tax Year 2023 How To File Your Salaried Income Tax Return For Tax Year 2022 Salary Youtube

38 000 After Tax 2021 Income Tax Uk

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

Sui Calculations Wrong Even After Qb Cs Agent Made Adjustments

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

What Is Included In A Payroll Quora

Income Tax Calcuation 2022 23 Or Ay 2023 24 How To Calculate Income Tax 2022 23 Youtube

Listentotaxman Com At Wi Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

China Annual One Off Bonus What Is The Income Tax Policy Change